58+ what percentage of salary should go to mortgage australia

Web In Australia most experts recommend that you shouldnt spend more than 30 of your income on housing costs mortgage payments insurance etc. As a foreigner you can expect interest rates of up to.

Live Cbre Australia

Web Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a.

. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Premium Statistic Housing cost income share for mortgage. Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment.

Web Under this method 50 of your income is put towards necessities like housing and food 30 goes towards wants like going out or entertainment and 20 is. Web 5000 x 036 36 1800 Maximum debt obligation including mortgage payment Going by the 28 percent rule the borrower should be able to reasonably. Web As a rough rule of thumb you dont want to spend more than 30 of your income on mortgage repayments.

VOO 158 or iShares Core SP 500 ETF IVV 160-- is a fund that tracks the SP. You cant go wrong with an SP 500 ETF. Web This refers to the recommendation that you should not spend any more than 28 of your gross income on the total amount you pay for your mortgage monthly.

Web Getting a mortgage in Australia isnt easy and the deals available to you will depend on your circumstances. Dental insurance costs vary based on the coverage and other factors. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Web The average monthly cost for a senior dental insurance policy for a 70-year-old is 5149. Web 11 minutes agoBest Mortgage Lenders. So a very quick way to work out what you can afford.

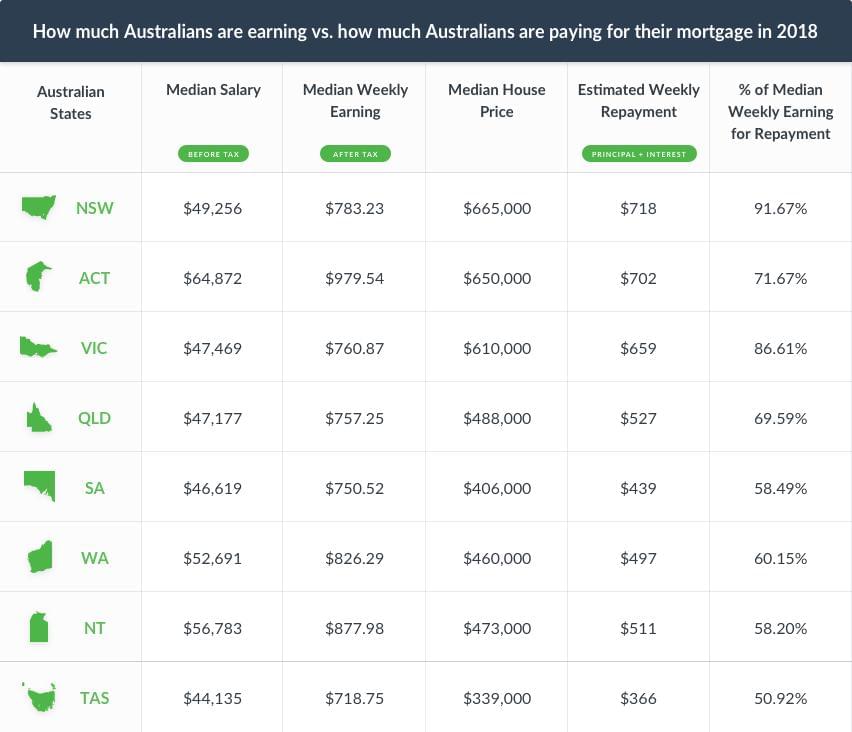

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Web The house price-to-income ratio in Australia was 1206 percent as of the fourth quarter of 2021. Web Mortgage stress for Australians has reached an all-time high.

Across the country more than one million households are estimated to now be in mortgage. Web As a general rule mortgage repayments should be less than 30 per cent of your pre-tax income to avoid falling into mortgage stress. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

A standard definition of mortgage stress is paying more than 30 per cent of your household income before tax on your. And you should make. So if your gross.

Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income or. Web Mortgage stress and the 30 per cent rule.

How Much Must You Earn To Pay Off Your Property By 50 Money News Asiaone

How Much Money Do I Need To Make Before Buying A House

How Much Of Your Income Should You Spend On Your Mortgage Money Magazine

Australian Families Spend 36 Per Cent Of Their Income On Their Mortgage

Debt How Do I Account For Monthly Expenses When Calculating How Much House I Can Afford Personal Finance Money Stack Exchange

Mortgage Repayments As A Percentage Of Income Download Scientific Diagram

Is 40 Per Cent Of My Income Too Much For Home Loan Repayments Infochoice

Live Cbre Australia

How Much To Borrow For A Home If You Want To Avoid Financial Stress Abc Everyday

How Much Can I Afford To Borrow For A Home Loan Finder

Australian Families Spend 36 Per Cent Of Their Income On Their Mortgage

Live Cbre Australia

How Much Is The Average Australian Mortgage Outpacing Salaries Moneyquest Blog

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram

Calameo Madeira And The Canary Islands

How Much Do You Need To Earn To Afford A House In Australia Openagent News

Aussie Homeowners Spend 41 4 Of Their Income On A Mortgage Lendi